Background

One of the biggest themes in 2022 was the organization’s re-focus on conversion and growth.

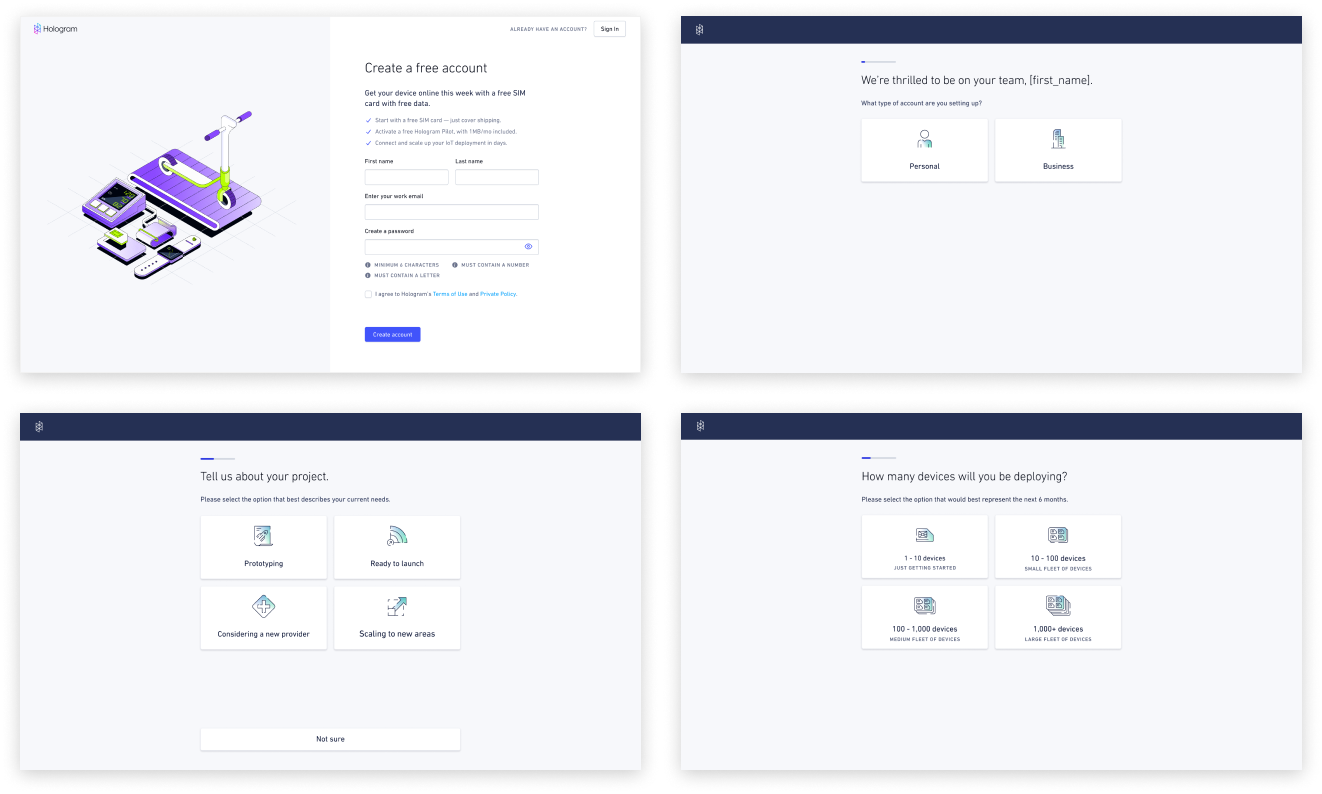

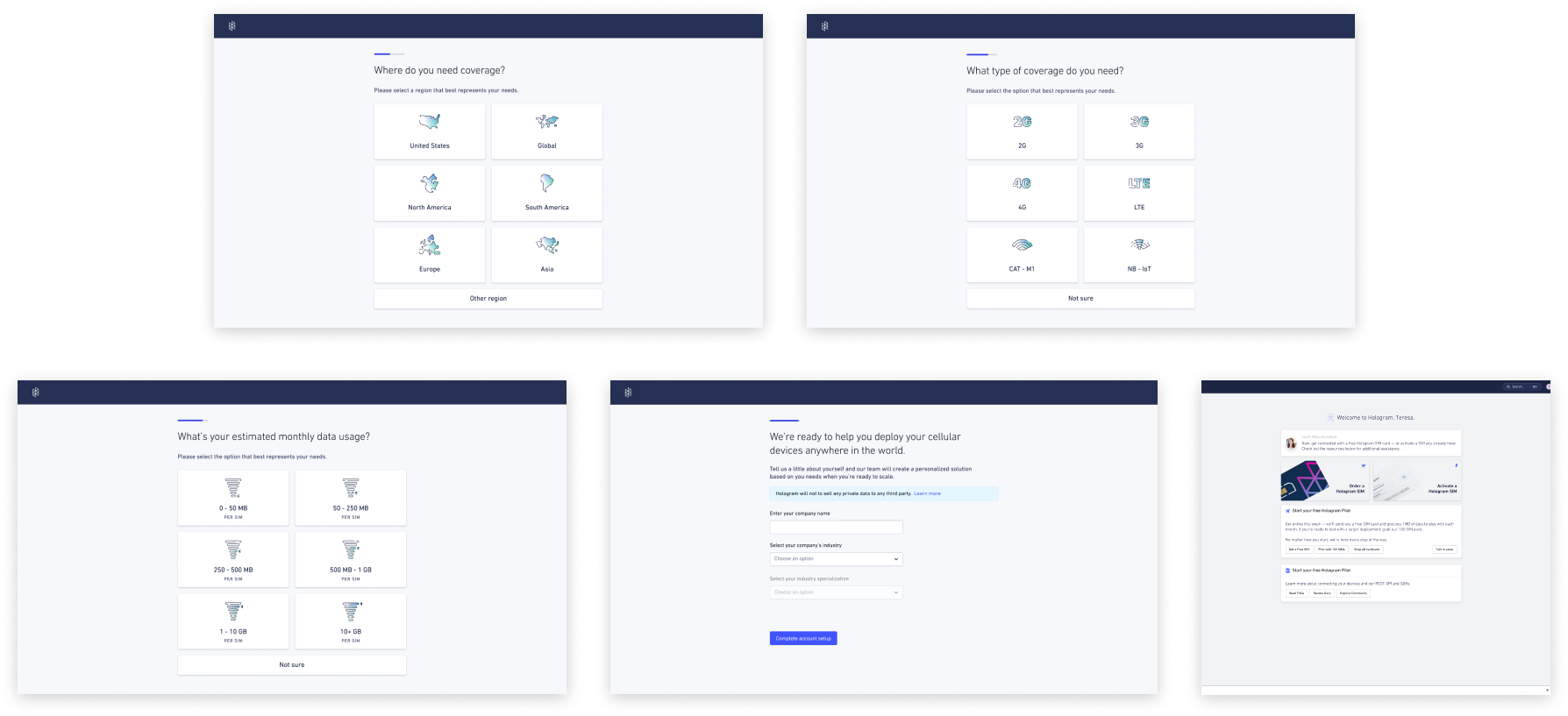

Customers at Hologram were divided into two segments: self-service and contracted customers. Not much is known about self-service customers however they do tend to follow these characteristics: preferred limited or simple data plan, typically within their located region; activated between 1-30 SIMs; and were typically in their business stage of primarily testing or validating their product.

In contrast, we had much more insights on contracted customers due our direct dialogue with them: they typically seeked a customized data plan tailored to their specific needs; they typically activated > 50 SIMs; and they were either at the tailend of testing, scaling their product for launch, or seeking expansion into a new region.

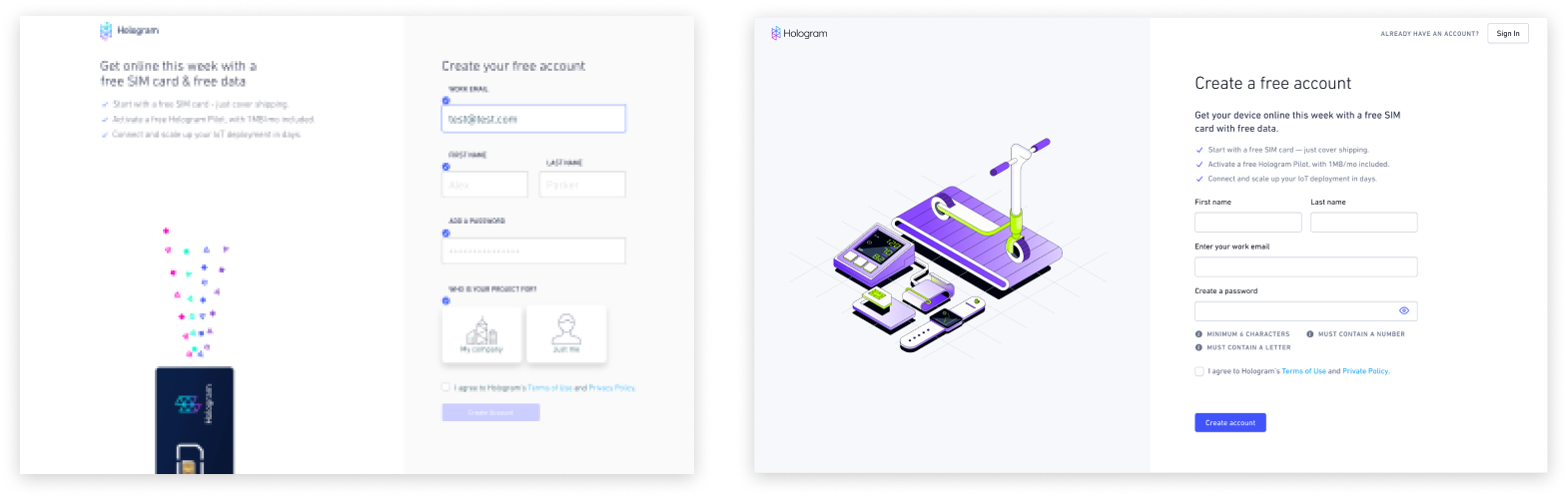

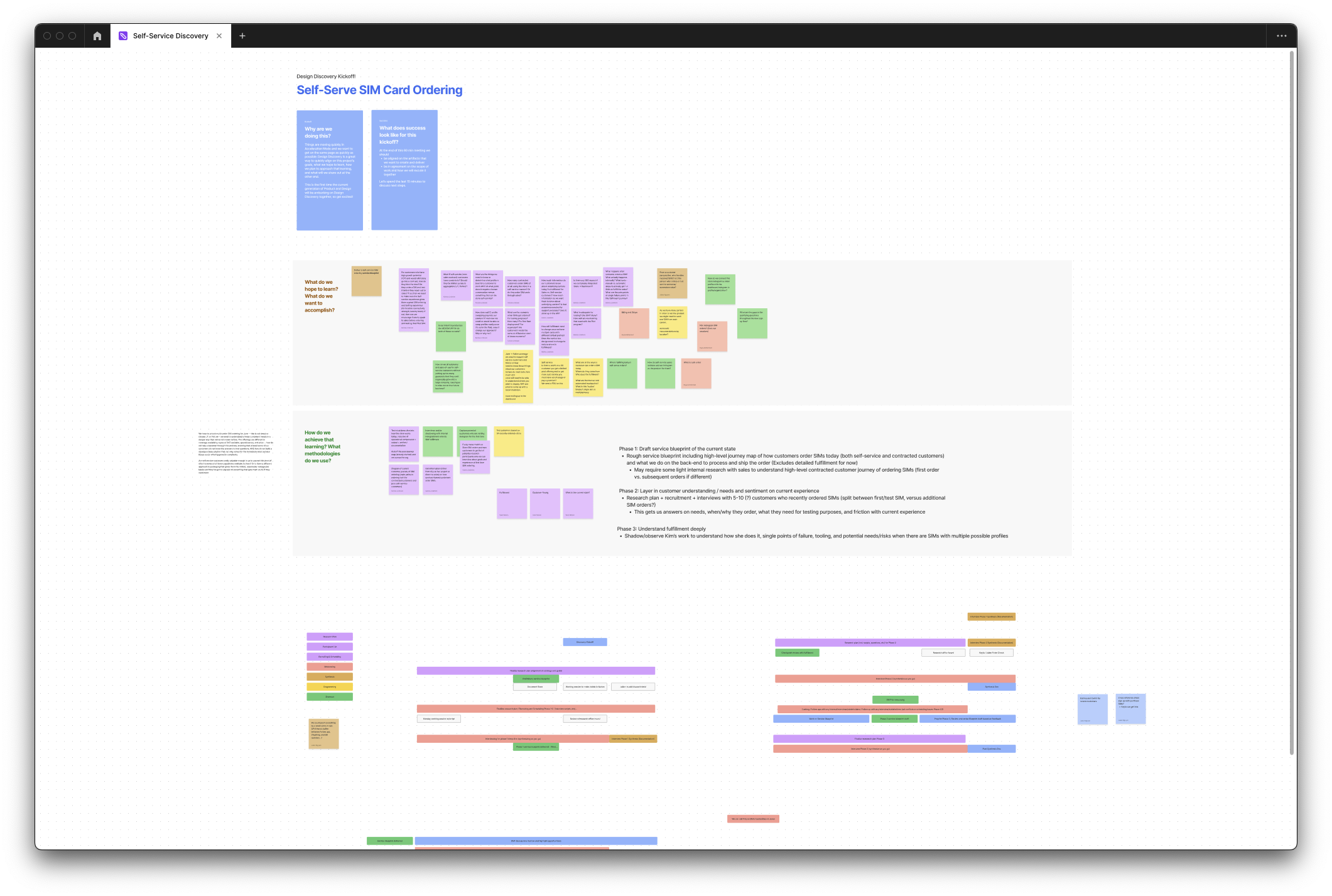

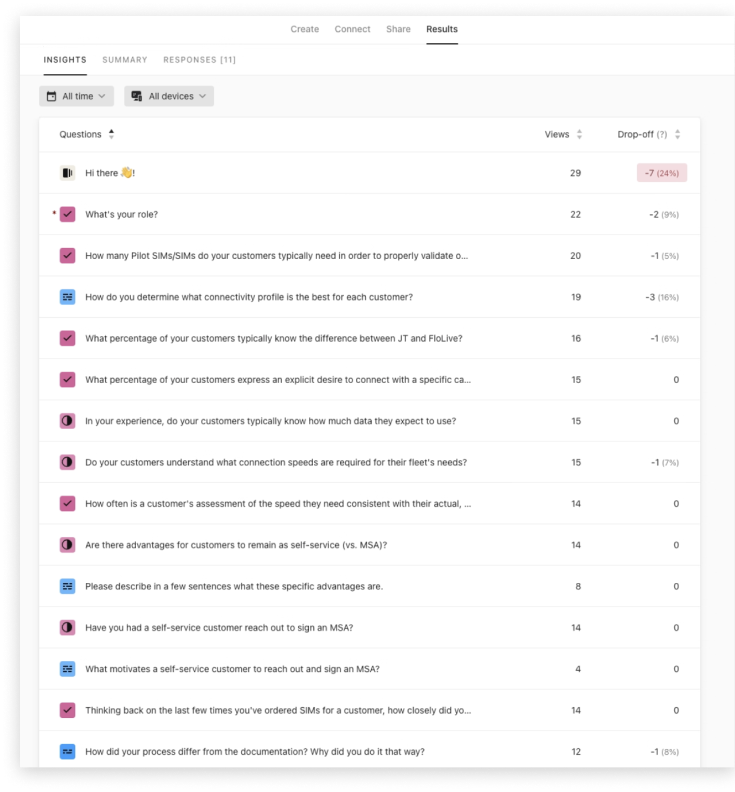

One of the main challenges with self-service customers was that we had know real way of knowing who they were and why they were creating accounts (besides needing service). In addition to streamlining the sign-up page, there was enthusiasm for us to proactively solicit insights from our self-service users during the onboarding phase so that our sales team could better position our product based on their current needs.

1. Sign Up & Qualification Flow Wireframes2. Sign Up & Qualification Flow Handoffs3. Sign Up Page - Before & After4. Qualification Flow Part 15. Qualification Flow Part 2

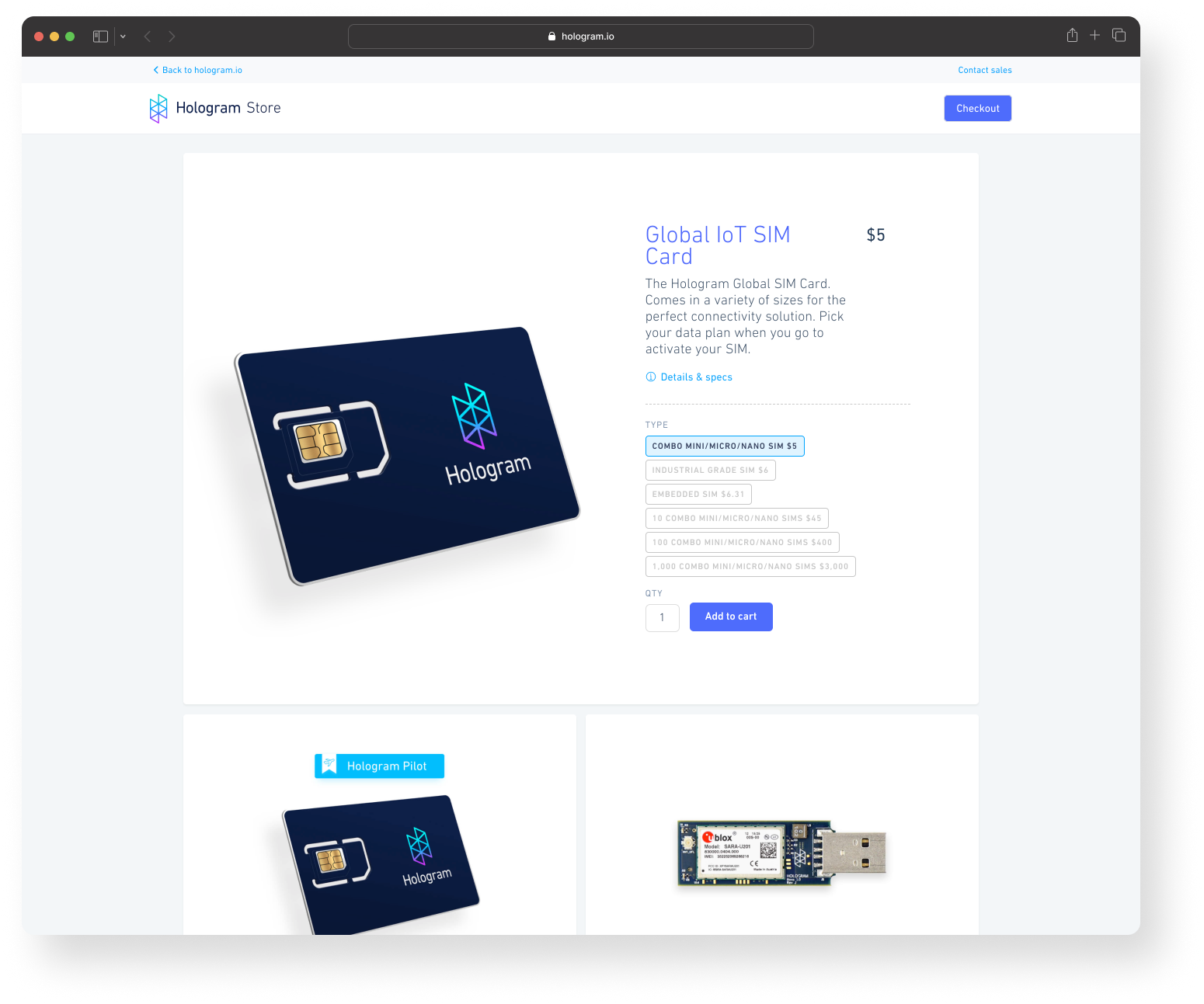

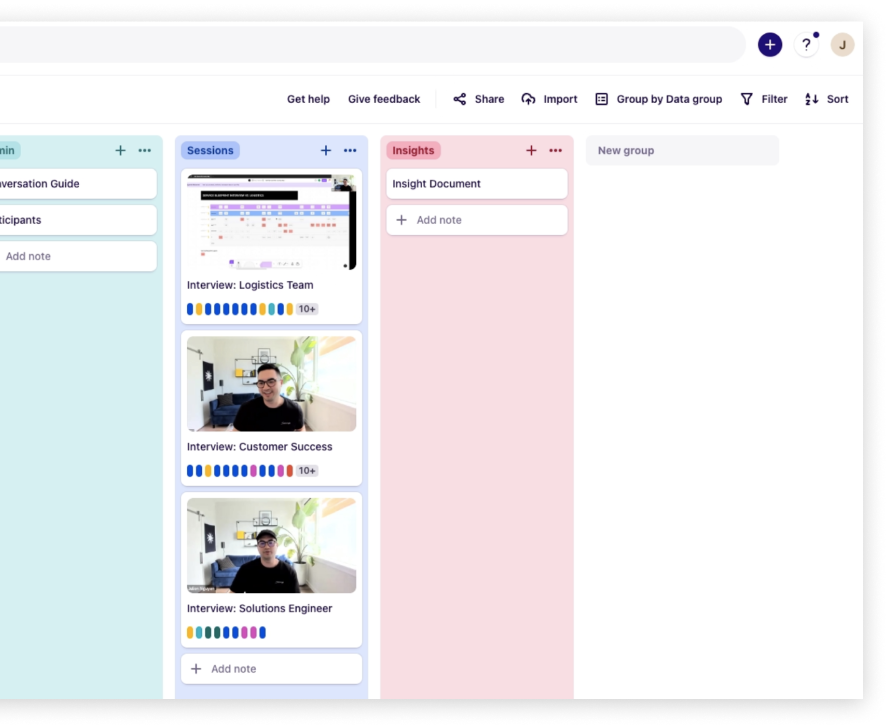

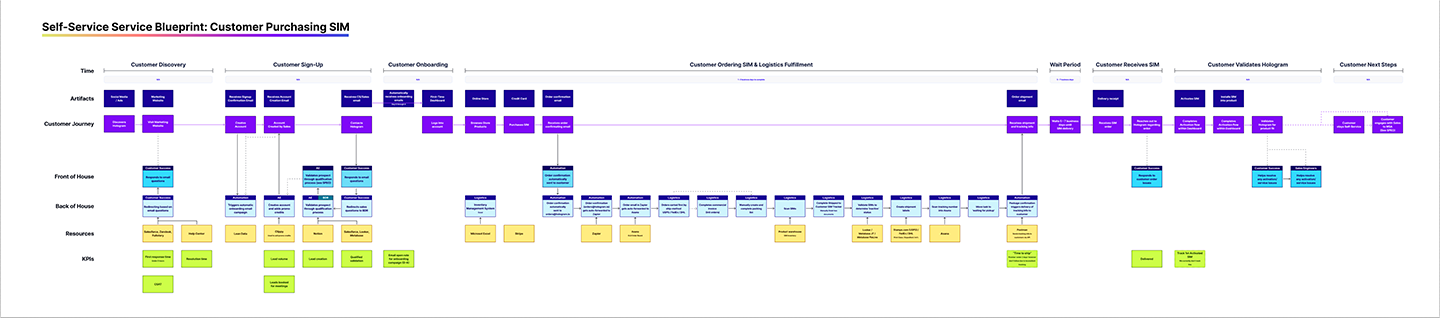

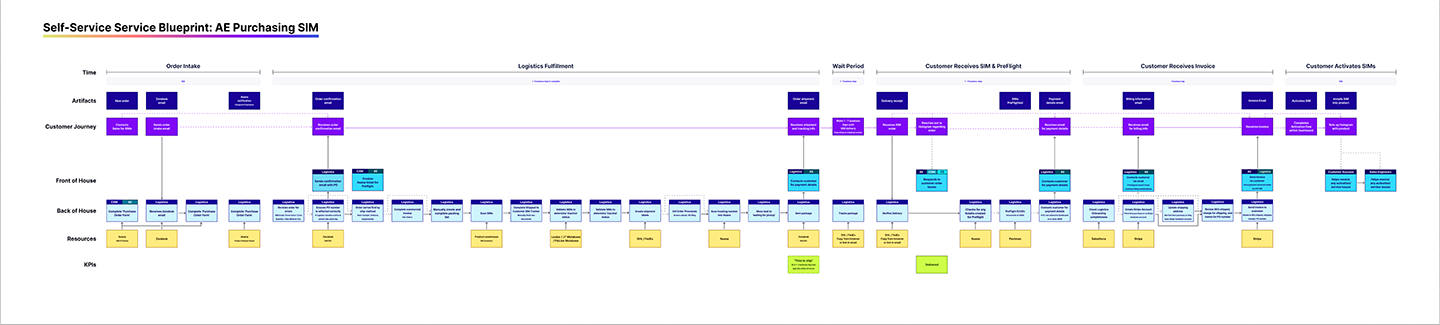

As we were collecting insights from our self-service customers, we also needed to understand the SIM purchasing process in a more holistic way that we've previously understood so that we when we were able to successfully transition self-service customers into contracts, our organization could confidently support the increased sales.